ACC 497 Week 5 Final Exam | Assignment Help | University Of Phoenix

- University of Phoenix / ACC 497

- 25 Oct 2019

- Price: $25

- Other / Other

ACC 497 Week 5 Final Exam | Assignment Help | University Of Phoenix

1.

Which of the following are major factors in

the rapidly changing financial reporting environment in Canada?

·

Financial

forecasting and planning for business.

·

Globalization

and the use of computer networks.

·

Increased

demand for accountants and the impact of technology.

·

The

growing number of institutional investors and the knowledge based economy.

2.

Under

the existing GAAP hierarchy for state and local government financial reporting,

the GASB Implementation guides are:

·

More

authoritative than the AICPA state and local government audit guide.

·

Less

authoritative than GASB Technical Bulletins.

·

More

authoritative than GASB Statements.

·

Equally

authoritative to AICPA Practice Bulletins.

3.

Which of the following are government-wide

financial statements required by GASB standards?

·

Statement

of activities and statement of cash flows.

·

Statement

of net position and statement of cash flows.

·

Statement

of net position and statement of activities.

·

Statement

of net position, statement of activities, and statement of cash flows.

4.

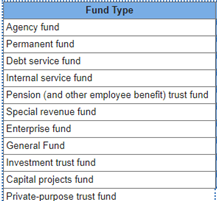

For each of the following fund types, indicate the fund category by selecting either Governmental funds, Proprietary funds, or Fiduciary funds for each item.

5. All of the following reports are included in

the reporting package resulting from the single audit except:

·

Financial

statements and schedule of expenditures of federal awards.

·

Report

on efficiency and effectiveness.

·

Summary

schedule of prior audit findings.

·

Corrective

action plan.

6.

Refer to the following selected financial

information from McCormik, LLC. Compute the company's accounts receivable

turnover for Year 2.

Year

2 Year 1

Cash $ 38,200 $

32,950

Short-term

investments 97,000 63,500

Accounts

receivable, net 89,000 83,000

Merchandise

inventory 124,500 128,500

Prepaid

expenses 12,800 10,400

Plant

assets 391,500 341,500

Accounts

payable 109,900 111,300

Net

sales 714,500 679,500

Cost

of goods sold 393,500 378,500

·

8.31.

·

8.61.

·

5.74.

· 7.37.

· 8.03.

7.

During the coming years, we should expect the ACSB to:

·

All

of these choices are correct.

·

harmonize

Canadian GAAP to international standards.

·

extend

differential reporting options available to private companies.

· continue to provide accounting standards for private companies.

8.

Juanita,

a Texas resident (5th Circuit), is researching a tax question and finds a 5th

Circuit case ruling that is favorable and a 9th Circuit case that is

unfavorable. Which circuit case has more “authoritative weight”?

·

5th

Circuit.

·

9th

Circuit.

·

6th

Circuit.

· 11th Circuit.

9.

Refer to the following selected financial information from McCormik, LLC. Compute the company's working capital for Year 2.

Year

2 Year 1

Cash $ 39,200 $ 33,950

Short-term

investments 107,000 68,500

Accounts

receivable, net 94,000 88,000

Merchandise

inventory 129,500 133,500

Prepaid

expenses 13,800 11,400

Plant

assets 396,500 346,500

Accounts

payable 104,900 116,300

Net

sales 719,500 684,500

Cost

of goods sold 398,500 383,500

·

$278,600.

·

$184,600.

·

$171,600.

· $149,100.

· $264,800.

10.

As part of your audit firm’s quality control

policies, it maintains a record of continuing profession education (CPE) taken

by professional staff members. Following is information on some of the classes,

sessions, workshops, and conferences that the auditors of your firm have

attended in the past year.

Required

Determine whether the classes, sessions, workshops, and conferences attended by the auditors could be used to meet the GAGAS requirement that auditors earn 24 hours of CPE in government-related areas every two years. Access the GAO guide entitled Government Auditing Standards: Guidance on GAGAS Requirements for Continuing Professional Education at the GAO Web site to perform research. For each of the following item, indicate whether its qualifies or Does not qualify.

11.

Which of the following statements regarding

cash flows is not accurate?

·

Before

the present cash flow statement standard became effective, companies had a

choice of whether to report cash flow from operating activities or working

capital from operating activities.

·

Information

about the balances of current liabilities, long-term debt and stockholders'

equity can be found in the statement of cash flows.

·

Studies

have shown that a cash flows report is more relevant to investor decisions than

a working capital report.

·

The

reported cash flow from operating activities has been found useful in

evaluating a firm's ability to make interest payments and repay debt.

· Information about past cash flows is useful in predicting an entity's future cash flows.

12.

The role of the Accounting Standards Board

(AcSB) in the formulation of accounting principles in Canada can be best

described as:

·

non-existent.

·

sometimes

primary and sometimes secondary.

· secondary.

· primary.

13.

Professional accountants need a wide range of

knowledge and skills. Which of the following is not an example of such

knowledge or skills?

An ability to communicate in a concise and understandable manner.

14.

Refer to the following selected financial

information from Shakley's Incorporated. Compute the company's times interest

earned for Year 2.

Year

2 Year 1

Net

sales $ 480,500 $ 426,650

Cost

of goods sold 276,700 250,520

Interest

expense 10,100 11,100

Net

income before tax 67,650 53,080

Net

income after tax 46,450 40,300

Total

assets 317,900 290,400

Total

liabilities 179,400 167,700

Total

equity 138,500 122,700

________________________________________

·

4.6.

·

6.7.

·

5.6.

·

13.7.

· 7.7.

14.

Refer to the following selected financial

information from Shakley's Incorporated. Compute the company's times interest

earned for Year 2.

Year

2 Year 1

Net

sales $ 480,500 $ 426,650

Cost

of goods sold 276,700 250,520

Interest

expense 10,100 11,100

Net

income before tax 67,650 53,080

Net

income after tax 46,450 40,300

Total

assets 317,900 290,400

Total

liabilities 179,400 167,700

Total

equity 138,500 122,700

________________________________________

·

4.6.

·

6.7.

·

5.6.

·

13.7.

· 7.7.

15.

Jones Corp. reported current assets of

$200,000 and current liabilities of $141,500 on its most recent balance sheet.

The current assets consisted of $60,200 Cash; $40,900 Accounts Receivable; and

$98,900 of Inventory. The acid-test (quick) ratio is:

·

1.4:1.

·

1:1.

·

0.51:1.

·

0.71:1.

· 0.67:1.

16.

Eagle

Company, a public company, had a computer failure and lost part of its

financial data. As a result, the auditor was unable to obtain sufficient audit

evidence relating to Eagle’s inventory account. Assuming the inventory account

is at least material, the auditor would most likely choose either:

·

a

qualified opinion or an adverse opinion.

·

a

qualified opinion or a disclaimer of opinion.

· a qualified opinion with no explanatory paragraph or a qualified opinion with an explanatory paragraph.

· an unqualified opinion with no explanatory paragraph or an unqualified opinion with an explanatory paragraph.

17.

Generally

accepted accounting principles currently are promulgated primarily by the:

·

Canada

Customs and Revenue Agency.

·

Ontario

Securities Commission (OSC).

·

Canadian

Academic Accounting Association (CAAA).

· Accounting Standards Board (AcSB).

18.

Which

of the following statement(s) is(are) correct?

·

Companies

that use the disclosed basis of accounting are in effect using differential

reporting.

·

Both

"companies that use the disclosed basis of accounting are NOT allowed to

use differential reporting" and "when used, the disclosed basis of

accounting must comply with GAAP" are correct.

·

When

used, the disclosed basis of accounting must comply with GAAP.

·

Companies

that use the disclosed basis of accounting are NOT allowed to use differential

reporting.

·

An

ability to calculate and analyze data, and a facility with numbers.

·

Skills

derived from prior management experience.

· Knowledge of many disciplines such as finance, economics, management, marketing and statistics.

19.

Which of the following funds are proprietary

funds?

·

Enterprise

funds and internal service funds.

·

Proprietary

funds are not used in governmental accounting.

·

Internal

service funds, special revenue funds, and enterprise funds.

· Enterprise funds, investment trust funds, pension trust funds, and the General Fund.

20.

Generally accepted accounting principles

applicable to state and local governments require that

·

Only

those funds required by law and sound financial administration should be

established.

·

All

categories of funds must be established.

·

Only

governmental funds and proprietary funds should be established.

· Only those funds required by law, GASB standards, and sound financial administration should be established.

21.

Choose the type of fund that would most likely be reported in the examples given.

|

Example |

|

Construction of

public buildings. |

|

Costs of a central

purchasing and warehouse function. |

|

Gifts in which the

principal must be invested and preserved but the investment earnings must be

used to provide scholarships to children of police officers who died in the

line of duty. |

|

Administrative

expenses of the city manager’s office. |

|

Assets held for

external government participants in the government’s investment pool for the

purpose of earning investment income. |

|

Gifts in which the

principal must be invested and preserved but the investment earnings can be

used for public purposes. |

|

Costs of operating a

municipal swimming pool. |

|

Taxes collected on

behalf of another governmental unit. |

|

Assets held in trust

to provide retirement benefits for municipal workers. |

|

Principal and interest

payments on general long-term debt. |

|

Grant revenues

restricted for particular operating purposes. |

22.

Which of the following is a primary objective of financial reporting by state and local governments?

·

To

provide information that can be used for capital allocation decisions made by

external investors.

·

To

fulfill the government's statutory duty to report on cash received and cash

disbursed.

·

To

report on the legal requirements imposed on the government by its elected

officials.

·

To

provide information that can be used to assess a government's accountability.

23.

Balsam

City's library board is appointed by the city council, which has agreed to

subsidize the operating costs of the library at a material amount to be

determined each year. In addition, the city is paying debt service on general

obligation bonds issued to construct the library. Based on generally accepted

accounting principles (GAAP) criteria for defining the reporting entity:

·

The

library is a component unit.

·

The

library is a joint venture.

·

The

library is a special purpose government.

·

The

library is a jointly governed organization.

24.

Which of the following factors would not

indicate that a potential component unit (PCU) imposes a financial burden or

provides a financial benefit to the primary government?

·

The

primary government is obligated for the PCU's debt.

·

The

primary government is entitled to its share of any dividends distributed by the

PCU.

·

The

primary government is entitled to the PCU's resources.

·

The

primary government is obligated to provide financial support to the PCU.

25.

Rajan Company's most recent balance sheet

reported total assets of $2.04 million, total liabilities of $0.73 million, and

total equity of $1.31 million. Its Debt to equity ratio is:

·

0.64

·

0.36

·

1.00

·

0.56

·

1.80

26.

Use the following information to determine

whether the Development Special Revenue and the Debt Service Funds should be

reported as major funds based on asset amounts provided. Development Special

Revenue Fund Assets $740,000 Debt Service Fund Assets $150,000 Total

Governmental Fund Assets $7,500,000 Total Governmental Fund and Enterprise Fund

Assets $8,750,000

·

The

Debt Service Fund should be reported as major.

·

Neither

the Development Special Revenue Fund nor the Debt Service Fund should be

reported as major.

·

The

Development Special Revenue Fund should be reported as major.

·

Both

the Development Special Revenue Fund and the Debt Service Fund should be

reported as major.

Selected

current year company information follows:

Net

income $ 16,553

Net

sales 718,855

Total

liabilities, beginning-year 89,932

Total

liabilities, end-of-year 109,201

Total

stockholders' equity, beginning-year

204,935

Total

stockholders' equity, end-of-year

130,851

The

return on total assets is (Do not round intermediate calculations.):

·

2.69%.

·

6.19%.

·

2.44%.

·

2.30%.

·

2.99%.

28.

Which

of the following funds would be used to account for an activity that provides

centralized purchasing and sales of goods or services to other departments or

agencies of the government on a cost-reimbursement basis?

·

Internal

service fund.

·

Permanent

fund.

·

Enterprise

fund.

·

Fiduciary

fund.

Q.29

Tech

Company has disclosed an uncertainty due to pending litigation. The auditor’s

decision to issue a qualified opinion on Tech’s financial statements would most

likely result from:

·

the

entity’s lack of experience with such litigation.

·

a

lack of sufficient evidence.

·

an

inability to estimate the amount of loss.

·

a

lack of insurance coverage for possible losses from such litigation.

30.

General-purpose financial statements report

financial information relevant to:

·

creditors

only.

·

investors

only.

·

investors,

creditors and government users.

·

government

users only.

USA

USA  India

India