ACCT 241 Practice Exam II | American University | American University

- american-university / ACCT 241

- 09 Aug 2019

- Price: $20

- Other / Other

ACCT 241 Practice Exam II | American University | American University

1.

Assume

a company sells a single product. If Q equals the level of output, P is the

selling price per unit, V is the variable expense per unit, and F is the fixed

expense, then the break-even point in sales dollars is:

Multiple Choice

F/(P-V).

F/[Q(P-V)].

F/[Q(P-V)/P].

F/[(P-V)/P].

2.

Sales in North Corporation increased from $60,000

per year to $63,000 per year while net operating income increased from $10,000

to $12,000. Given this data, the company's degree of operating leverage must

have been:

Multiple Choice

4.0

1.5

5.0

21.0

3.

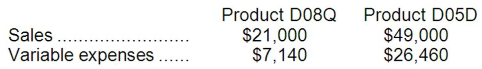

The fixed expenses of the entire company were

$30,970. If the sales mix were to shift toward Product D08Q with total dollar

sales remaining constant, the overall break-even point for the entire company:

Multiple Choice

would

increase.

would decrease.

would

not change.

could

increase or decrease.

4.

Trumbull

Corporation budgeted sales on account of $120,000 for July, $211,000 for

August, and $198,000 for September. Experience indicates that none of the sales

on account will be collected in the month of the sale, 60% will be collected

the month after the sale, 36% in the second month, and 4% will be

uncollectible. The cash receipts from accounts receivable that should be

budgeted for September would be:

Multiple Choice

$169,800

$147,960

$197,880

$194,760

5.

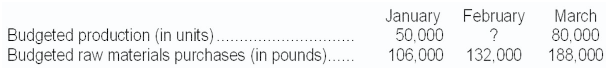

Marst Corporation's

budgeted production in units and budgeted raw materials purchases over the next

three months are given below:

Two pounds of raw materials are required to produce

one unit of product. The company wants raw materials on hand at the end of each

month equal to 30% of the following month's production needs. The company is

expected to have 30,000 pounds of raw materials on hand on January 1. Budgeted

production for February should be:

Multiple Choice

60,000

units

54,000

units

84,000

units

108,000

units

6.

Vandel Inc. bases its selling and administrative

expense budget on budgeted unit sales. The sales budget shows 6,600 units are

planned to be sold in April. The variable selling and administrative expense is

$9.70 per unit. The budgeted fixed selling and administrative expense is

$127,380 per month, which includes depreciation of $8,580 per month. The

remainder of the fixed selling and administrative expense represents current cash

flows. The cash disbursements for selling and administrative expenses on the

April selling and administrative expense budget should be:

Multiple Choice

$191,400

$118,800

$64,020

$182,820

7.

|

The

Wright Company has a standard costing system. The following data are

available for September: |

|

Actual

quantity of direct materials purchased |

70,000

|

pounds |

|

Standard

price of direct materials |

$8

|

per

pound |

|

Material

price variance |

$3,500

|

unfavorable |

|

Material

quantity variance |

$2,500

|

favorable |

|

The actual price per pound of direct materials purchased in September is: (Round your answer to 2 decimal places.) |

Multiple Choice

$7.93

$8.00

$8.05

$8.07

8.

|

Blue

Corporation's standards call for 4,125 direct labor-hours to produce 1,650

units of product. During May 1,150 units were produced and the company worked

1,550 direct labor-hours. The standard hours allowed for May production would

be: |

Multiple

Choice

4,125

hours

1,550

hours

2,875

hours

2,975 hours

9.

|

The

following standards for variable manufacturing overhead have been established

for a company that makes only one product: |

|

Standard

hours per unit of output |

7.2 |

hours |

|

Standard

variable overhead rate |

$13.60 |

per

hour |

|

The

following data pertain to operations for the last month: |

|

Actual

hours |

2,750 |

hours |

|

Actual

total variable manufacturing overhead cost |

$38,090 |

|

|

Actual

output |

250 |

units |

|

What

is the variable overhead efficiency variance for the month? |

Multiple Choice

$13,610

U

$12,920

U

$690

F

$24,480 F

10.

|

Given

the following data: |

|

Average

operating assets |

$688,000

|

|

Total

liabilities |

$103,200 |

|

Sales |

$344,000 |

|

Contribution

margin |

$196,080 |

|

Net

operating income |

$61,920 |

|

Return

on investment (ROI) would be: |

Multiple Choice

18.0%

9.0%

57.0%

28.5%

11.

|

Last

year a company had sales of $350,000, a turnover of 2.2, and a return on

investment of 46.2%. The company's net operating income for the year was: |

Multiple Choice

$88,200

$159,091

$161,700

$73,500

12.

Given the following data:

|

Return

on investment |

30%

|

|

Turnover |

2.2

|

|

Margin |

9%

|

|

Sales |

$220,000

|

|

Average

operating assets |

$66,000

|

|

Minimum

required rate of return |

20%

|

|

The

residual income would be: |

Multiple Choice

$6,600

$0

$13,860

$24,200

13.

Lampshire Inc. is considering using stocks of an old

raw material in a special project. The special project would require all 150

kilograms of the raw material that are in stock and that originally cost the

company $2,346 in total. If the company were to buy new supplies of this raw

material on the open market, it would cost $7.90 per kilogram. However, the

company has no other use for this raw material and would sell it at the

discounted price of $7.20 per kilogram if it were not used in the special

project. The sale of the raw material would involve delivery to the purchaser

at a total cost of $74 for all 150 kilograms. What is the relevant cost of the

150 kilograms of the raw material when deciding whether to proceed with the

special project?

Multiple Choice

$1,080

$1,006

$1,165

$1,185

14.

|

The

management of Heider Corporation is considering dropping product H58S. Data

from the company's accounting system appear below: |

|

Sales |

$920,000 |

|

Variable

expenses |

$386,000 |

|

Fixed

manufacturing expenses |

$368,000 |

|

Fixed

selling and administrative expenses |

$248,000 |

|

In

the company's accounting system all fixed expenses of the company are fully

allocated to products. Further investigation has revealed that $229,000 of

the fixed manufacturing expenses and $190,000 of the fixed selling and

administrative expenses are avoidable if product H58S is discontinued. What

would be the effect on the company's overall net operating income if product

H58S were dropped? |

Multiple Choice

Overall

net operating income would decrease by $82,000.

Overall

net operating income would increase by $115,000.

Overall

net operating income would increase by $82,000.

Overall

net operating income would decrease by $115,000

15

|

Consider

the following production and cost data for two products, L and C: |

|

|

Product

L |

Product

C |

|

Contribution

margin per unit |

$32

|

$30

|

|

Machine-hours

needed per unit |

4

hours |

3

hours |

|

The

company can only perform 15,000 machine hours each period, due to limited

skilled labor and there is unlimited demand for each product. What is the

largest possible total contribution margin that can be realized each period? |

Multiple Choice

$135,000

$137,500

$150,000

$165,000

16.

Menlo Company distributes a single product. The

company’s sales and expenses for last month follow:

|

|

Total

|

Per

Unit |

|||

|

Sales |

$ |

616,000 |

|

$ |

40

|

|

Variable

expenses |

|

431,200 |

|

|

28

|

|

|

|

|

|

|

|

|

Contribution

margin |

|

184,800 |

|

$ |

12

|

|

Fixed

expenses |

|

152,400 |

|

|

|

|

|

|

|

|

|

|

|

Net

operating income |

$ |

32,400 |

|

|

|

|

|

|

|

|

|

|

|

Required: |

|

|

1. |

What

is the monthly break-even point in unit sales and in dollar sales? |

|

2. |

Without

resorting to computations, what is the total contribution margin at the

break-even point? |

|

3-a |

How

many units would have to be sold each month to earn a target profit of

$69,600? Use the formula method. |

||

|

|||

|

|||

|

3-b. |

Verify

your answer by preparing a contribution format income statement at the target

sales level. |

|

|

|

4. |

Refer

to the original data. Compute the company's margin of safety in both dollar

and percentage terms. Round your

percentage answer to 2 decimal places (i.e .1234 should be entered as 12.34). |

|

5. |

What

is the company’s CM ratio? If monthly sales increase by $58,000 and there is

no change in fixed expenses, by how much would you expect monthly net operating

income to increase? |

Pearl

Products Limited of Shenzhen, China, manufactures and distributes toys

throughout South East Asia. Three cubic centimeters (cc) of solvent H300 are

required to manufacture each unit of Supermix, one of the company’s products.

The company now is planning raw materials needs for the third quarter, the

quarter in which peak sales of Supermix occur. To keep production and sales

moving smoothly, the company has the following inventory requirements:

- The

finished goods inventory on hand at the end of each month must equal 2,000

units of Supermix plus 25% of the next month’s sales. The finished goods

inventory on June 30 is budgeted to be 14,250 units.

- The

raw materials inventory on hand at the end of each month must equal one-half

of the following month’s production needs for raw materials. The raw

materials inventory on June 30 is budgeted to be 75,375 cc of solvent

H300.

- The

company maintains no work in process inventories.

A

monthly sales budget for Supermix for the third and fourth quarters of the year

follows.

|

|

Budgeted

Unit Sales |

|

July |

49,000 |

|

August |

54,000 |

|

September |

64,000 |

|

October |

44,000 |

|

November |

34,000 |

|

December |

24,000 |

|

|

|

Required:

1.

Prepare a production budget for Supermix for the months July, August, September,

and October.

3. Prepare a direct materials budget showing the quantity of solvent H300 to be purchased for July, August, and September, and for the quarter in total.

18.

|

Dawson

Toys, Ltd., produces a toy called the Maze. The company has recently established

a standard cost system to help control costs and has established the

following standards for the Maze toy: |

|

Direct

materials: 8 microns per toy at $0.33 per micron |

|

Direct

labor: 1.2 hours per toy at $7.00 per hour |

|

During

July, the company produced 5,000 Maze toys. Production data for the month on

the toy follow: |

|

Direct materials: 74,000 microns were purchased

at a cost of $0.30 per micron. 24,000 of these microns were still in

inventory at the end of the month. |

|

Direct labor: 6,400 direct labor-hours were worked at a cost of

$48,640. |

|

Required: |

|

|

1. |

Compute

the following variances for July: (Indicate

the effect of each variance by selecting "F" for favorable,

"U" for unfavorable, and "None" for no effect (i.e., zero

variance). Do not round intermediate calculations. Round final answer to the

nearest whole dollar.) |

|

a. |

The

materials price and quantity variances. |

||

|

||||

|

||||

|

b. |

The labor rate and efficiency variances. 19. Provide the missing data in the following table for

a distributor of martial arts products: (Enter

"Turnover" and "ROI" answers to 1 decimal place.)

20. Delta

Company produces a single product. The cost of producing and selling a single

unit of this product at the company’s normal activity level of 91,200 units per

year is:

The

normal selling price is $22.00 per unit. The company’s capacity is 112,800

units per year. An order has been received from a mail-order house for 1,800

units at a special price of $19.00 per unit. This order would not affect

regular sales or the company’s total fixed costs. Required: 1.

What is the financial advantage (disadvantage) of accepting the special order? 2.

As a separate matter from the special order, assume the company’s inventory

includes 1,000 units of this product that were produced last year and that are

inferior to the current model. The units must be sold through regular channels

at reduced prices. The company does not expect the selling of these inferior

units to have any effect on the sales of its current model. What unit cost is

relevant for establishing a minimum selling price for these units? Required 1 What is the financial advantage (disadvantage) of

accepting the special order? Required 2 As a separate matter from the special order, assume

the company’s inventory includes 1,000 units of this product that were produced

last year and that are inferior to the current model. The units must be sold

through regular channels at reduced prices. The company does not expect the

selling of these inferior units to have any effect on the sales of its current

model. What unit cost is relevant for establishing a minimum selling price for

these units? (Round your answer to 2 decimal places.)

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

USA

USA  India

India

Question Attachments

0 attachments —