ACCT 241 Week 1 Assignment Help | Quiz | American University

- american-university / ACCT 241

- 26 Jul 2019

- Price: $20

- Other / Other

ACCT 241 Week 1 Assignment Help | Quiz | American University

1.

Required information

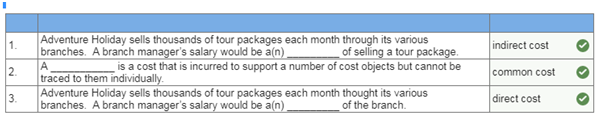

We will discuss the differences between direct and indirect costs. A direct cost is a cost that can be easily and conveniently traced to a cost object. An indirect cost is a cost that cannot be easily and conveniently traced to a cost object. A common cost is a type of an indirect cost. A particular cost may be direct or indirect, depending on the cost object.

Knowledge Check 01

Match the term and the definition.

2.

Required information

We will discuss the three basic categories of manufacturing costs: direct materials, direct labor, and manufacturing overhead. We will also cover the various nonmanufacturing costs in an organization.

Knowledge Check 01

Manufacturing costs include all of the following except ________.

o administrative

o direct labor

o direct materials

o manufacturing overhead

3.

Required information

We will discuss the three basic categories of manufacturing costs: direct materials, direct labor, and manufacturing overhead. We will also cover the various nonmanufacturing costs in an organization.

Knowledge Check 01

Materials that become an integral part of the finished product and whose costs can be conveniently traced to the finished product are called ________.

o raw materials

o direct materials

o indirect materials

4.

Required information

We will discuss the three basic categories of manufacturing costs: direct materials, direct labor, and manufacturing overhead. We will also cover the various nonmanufacturing costs in an organization.

Knowledge Check 01

________ is sometimes called “touch labor.”

o Direct labor

o Indirect labor

o Overhead labor

5.

Required information

We will discuss the three basic categories of manufacturing costs: direct materials, direct labor, and manufacturing overhead. We will also cover the various nonmanufacturing costs in an organization.

Knowledge Check 01

Items such as indirect materials, indirect labor, maintenance and repairs on production equipment, depreciation, and insurance on manufacturing facilities are included in ________.

o nonmanufacturing costs

o manufacturing overhead costs

o direct costs

6.

Required information

We will discuss the three basic categories of manufacturing costs: direct materials, direct labor, and manufacturing overhead. We will also cover the various nonmanufacturing costs in an organization.

Knowledge Check 01

Property taxes associated with a company's administrative facility are considered ________.

o nonmanufacturing costs

o manufacturing overhead costs

o direct costs

7.

Required information

We classify costs as either product costs or period costs. Product costs include all costs involved in acquiring or making a product. For most companies, period costs include all selling and administrative expenses. We also discuss the difference between prime cost and conversion cost. Prime cost is the sum of direct materials cost and direct labor cost. Conversion cost is the sum of direct labor cost and manufacturing overhead cost.

Knowledge Check 01

________ best describe the wages of a sheet metal worker in a fabrication plant.

o Product costs

o Period costs

o Nonmanufacturing costs

o Administrative costs

Knowledge Check 02

The ________ requires that the costs incurred to generate a particular revenue should be recognized as expenses in the same period that the revenue is recognized.

o materiality concept

o consistency concept

o matching principle

o going concern assumption

8.

Required information

We classify costs as either product costs or period costs. Product costs include all costs involved in acquiring or making a product. For most companies, period costs include all selling and administrative expenses. We also discuss the difference between prime cost and conversion cost. Prime cost is the sum of direct materials cost and direct labor cost. Conversion cost is the sum of direct labor cost and manufacturing overhead cost.

Knowledge Check 01

________ is common to both prime cost and conversion cost.

o Manufacturing overhead

o Direct materials

o Nonmanufacturing costs

o Direct labor

Knowledge Check 02

Which observation is true of period costs?

o They are expensed in the period in which they are incurred.

o They are included as part of the cost of manufactured goods.

o They include costs that are incurred to convert materials into the finished product.

o They are also known as inventoriable costs.

9.

Required information

We discussed cost behavior and cost structure. Costs are often categorized as variable, fixed, or mixed. A variable cost varies, in total, in direct proportion to changes in the level of activity. A fixed cost is a cost that remains constant, in total, regardless of changes in the level of activity. A mixed cost contains both variable and fixed cost elements. We also discuss the significance of relevant range that affects cost behavior.

Knowledge Check 01

If a firm increases its activity level, ________.

o costs will remain the same

o all costs will rise

o some costs will change, other costs will remain the same

10.

Required information

We discussed cost behavior and cost structure. Costs are often categorized as variable, fixed, or mixed. A variable cost varies, in total, in direct proportion to changes in the level of activity. A fixed cost is a cost that remains constant, in total, regardless of changes in the level of activity. A mixed cost contains both variable and fixed cost elements. We also discuss the significance of relevant range that affects cost behavior.

Knowledge Check 01

Cyber Devices manufactures PCTV products that enable people to watch television content on their computers. It sells its product to retailers for $50. A tuner component that goes into each of these devices costs $5 to acquire. The total variable cost at an activity level of 1,000 units equal ________.

o $50,000

o $5

o $1,000

o $5,000

11.

Required information

We discussed cost behavior and cost structure. Costs are often categorized as variable, fixed, or mixed. A variable cost varies, in total, in direct proportion to changes in the level of activity. A fixed cost is a cost that remains constant, in total, regardless of changes in the level of activity. A mixed cost contains both variable and fixed cost elements. We also discuss the significance of relevant range that affects cost behavior.

Knowledge Check 01

A fixed cost is a cost which ________.

o varies in total with changes in the level of activity

o remains constant per unit with changes in the level of activity

o varies inversely in total with changes in the level of activity

o remains constant in total with changes in the level of activity

12.

Required information

We discussed cost behavior and cost structure. Costs are often categorized as variable, fixed, or mixed. A variable cost varies, in total, in direct proportion to changes in the level of activity. A fixed cost is a cost that remains constant, in total, regardless of changes in the level of activity. A mixed cost contains both variable and fixed cost elements. We also discuss the significance of relevant range that affects cost behavior.

Knowledge Check 01

In a small manufacturing facility, one welder is needed for every 200 hours of machine-hours or fewer in a month. The welder is paid a monthly salary of $2,500. If the total monthly requirement is 1,300 machine-hours, the total salaried employee expense is ________.

o $12,500

o $16,250

o $17,500

o $15,000

13.

Required information

We discussed cost behavior and cost structure. Costs are often categorized as variable, fixed, or mixed. A variable cost varies, in total, in direct proportion to changes in the level of activity. A fixed cost is a cost that remains constant, in total, regardless of changes in the level of activity. A mixed cost contains both variable and fixed cost elements. We also discuss the significance of relevant range that affects cost behavior.

Knowledge Check 01

In the equation, Y = a + bX, X represents ________.

o the total mixed cost

o the level of activity

o the total fixed cost

o the variable cost per unit of activity

14. Required information

We will discuss cost classifications used in making decisions: differential costs, sunk costs and opportunity costs. For purposes of making decisions, the concepts of differential cost and revenue, sunk cost, and opportunity cost are vitally important. Differential costs and revenues are the future costs and revenues that differ between alternatives. Sunk cost is a cost that occurred in the past and cannot be altered. Opportunity cost is the benefit forgone when one alternative is selected over another. Differential costs and opportunity costs are always relevant and should be carefully considered in decisions. Sunk costs are always irrelevant in decisions and should be ignored.

Knowledge Check 01

Differential costs are always ________.

o irrelevant in making business decisions

o relevant in making business decisions

o a sunk cost

15.

Required information

We will discuss cost classifications used in making decisions: differential costs, sunk costs and opportunity costs. For purposes of making decisions, the concepts of differential cost and revenue, sunk cost, and opportunity cost are vitally important. Differential costs and revenues are the future costs and revenues that differ between alternatives. Sunk cost is a cost that occurred in the past and cannot be altered. Opportunity cost is the benefit forgone when one alternative is selected over another. Differential costs and opportunity costs are always relevant and should be carefully considered in decisions. Sunk costs are always irrelevant in decisions and should be ignored.

Knowledge Check 01

________ is always an irrelevant cost.

o Differential cost

o Sunk cost

o Opportunity cost

16.

Required information

We will discuss cost classifications used in making decisions: differential costs, sunk costs and opportunity costs. For purposes of making decisions, the concepts of differential cost and revenue, sunk cost, and opportunity cost are vitally important. Differential costs and revenues are the future costs and revenues that differ between alternatives. Sunk cost is a cost that occurred in the past and cannot be altered. Opportunity cost is the benefit forgone when one alternative is selected over another. Differential costs and opportunity costs are always relevant and should be carefully considered in decisions. Sunk costs are always irrelevant in decisions and should be ignored.

Knowledge Check 01

Match the term and the definition.

17.

Required information

You will learn how to prepare traditional and contribution format income statements for a merchandising company. Traditional income statements are prepared primarily for external reporting purposes. They organize costs into two categories: cost of goods sold and selling and administrative expenses. The contribution approach overcomes the limitations of the traditional format and provides managers with an income statement that clearly distinguishes between fixed and variable costs and therefore aids in planning, controlling, and decision making.

Knowledge Check 01

The traditional income statement uses which of the following cost categories?

o Variable expenses and fixed expenses.

o Cost of goods sold and fixed expenses.

o Operating expenses and selling and administrative expenses.

o Cost of goods sold and selling and administrative expenses.

18.

Required information

You will learn how to prepare traditional and contribution format income statements for a merchandising company. Traditional income statements are prepared primarily for external reporting purposes. They organize costs into two categories: cost of goods sold and selling and administrative expenses. The contribution approach overcomes the limitations of the traditional format and provides managers with an income statement that clearly distinguishes between fixed and variable costs and therefore aids in planning, controlling, and decision making.

Knowledge Check 01

Which of the following is true of the contribution approach?

o It is mainly used for external reporting purposes.

o It separates costs into fixed and variable categories.

o It is not useful for merchandising companies.

o It calculates gross margin by deducting cost of goods sold from sales.

Knowledge Check 02

Davidson Company has a product with a selling price per unit of $100, the unit variable cost is $60, and the total monthly fixed costs are $30,000. If the company sells 1,000 units, how much is Davidson’s contribution margin per unit?

o $40,000

o $10,000

o $40

USA

USA  India

India

Question Attachments

0 attachments —