ACCT 360 Week 4 Accounting Assignment Help | Franklin University

- Franklin University / ACCT 360

- 25 Jan 2019

- Price: $10

- Other / Other

ACCT 360 Week 4 Accounting Assignment Help | Franklin University

Harvey City Comprehensive Case

CAPITAL PROJECTS FUNDS

Harvey City has two Capital Projects Funds in 20X4. The Parks and Recreation Capital Projects Fund is created in 20X4. The Bridge Capital Projects Fund was established in 20X3, and the bridge is completed in 20X4.

REQUIREMENTS—PARKS AND RECREATION CAPITAL PROJECTS FUND

- Prepare a worksheet for the Parks and Recreation Capital Projects Fund similar to the General Fund worksheet you created in Chapter 4. Enter the effects of the following transactions and events in the appropriate columns of the worksheet. (A different solution approach may be used if desired by your professor.)

- Enter the preclosing trial balance in the appropriate worksheet columns.

- Enter the preclosing trial balance amounts in the closing entry (operating statement data) and postclosing trial balance (balance sheet data) columns, as appropriate.

- Prepare the 20X4 statement of revenues, expenditures, and changes in fund balance for the Parks and Recreation Capital Projects Fund.

- Prepare the year end 20X4 balance sheet for the Parks and Recreation Capital Projects Fund.

TRANSACTIONS AND EVENTS—20X4—PARKS AND RECREATION CAPITAL PROJECTS FUND

- The city approved a major capital improvement project to construct a recreational facility. The project will be financed by a bond issue of $1,500,000, transfers from the General Fund of $500,000, and a contribution from the county of $300,000. Record the budget assuming these amounts, along with an equal appropriation for the project, were adopted for 20X4.

- The city received the county’s contribution of $300,000. These resources are required to be used for the construction project. (The grant is expenditure-driven. The city’s policies indicate that resources restricted for a given purpose are considered expended prior to any unrestricted resources available for that purpose.)

- The city transferred $200,000 from the General Fund to the Parks and Recreation Capital Projects Fund.

- The city issued bonds with a face (par) value of $1,500,000 at a premium of $50,000 on January 1. Bond issue costs of $15,000 were incurred. Interest of 8% per year and $100,000 of principal are due each December 31.

- The city signed a $2,190,000 contract for construction of the new recreational facility. The process to establish the contract qualifies as a commitment under the city’s commitments policy.

- The city purchased land as the site for the facility at a cost of $110,000. Payment was made for the land.

- The contractor billed the city $1,200,000. The city paid all but a 5% retainage.

- The outstanding encumbrances were closed. (Use the transactions columns for this entry.)

- The budgetary accounts were closed at year end. Appropriations do not lapse at year end. (Close the budgetary accounts in the transactions columns.)

REQUIREMENTS—BRIDGE CAPITAL PROJECTS FUND

- Prepare a worksheet for the Bridge Capital Projects Fund similar to the General Fund worksheet you created in Chapter 4. Enter the effects of the following transactions and events in the appropriate columns of the worksheet. (A different solution approach may be used if desired by your professor.)

- Enter the preclosing trial balance in the appropriate worksheet columns.

- Enter the preclosing trial balance amounts in the closing entry (operating statement data) and postclosing trial balance (balance sheet data) columns, as appropriate.

- Prepare the 20X4 statement of revenues, expenditures, and changes in fund balance for the Bridge Capital Projects Fund.

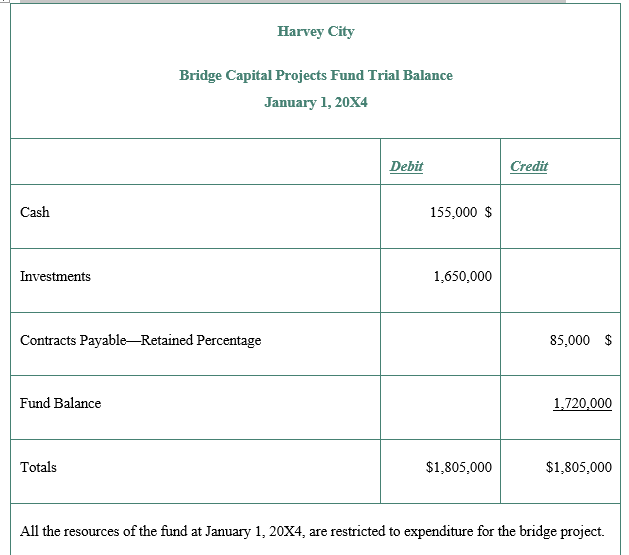

BEGINNING 20X4 TRIAL BALANCE—BRIDGE CAPITAL PROJECTS FUND

The trial balance for the Bridge Capital Projects Fund at January 1, 20X4, is presented here:

TRANSACTIONS AND EVENTS—20X4—BRIDGE CAPITAL

PROJECTS FUND

- Estimated revenues and other

financing sources for 20X2 included budgeted investment income of $25,000

and a budgeted transfer from the General Fund of $55,000. Unexpended

appropriations of $1,720,000 carried over from the prior year. (Record the

budget.)

- The city reestablished its

encumbrances of $1,720,000 that were closed at the end of 20X3.

- The contractor billed the

city $1,800,000 for the costs to complete the bridge. The project received

final approval. The total cost of $3,500,000 included costs of $1,700,000

incurred in 20X3.

- The city sold the Capital

Projects Fund investments for $1,660,000, a gain of $10,000.

- The city transferred $70,000

from the General Fund to the Bridge Capital Projects Fund.

- The city paid the contractor

the balance due, $1,885,000, and the fund was terminated.

- The budgetary accounts were

closed at year end. (Close the budgetary accounts in the transactions

columns.)

USA

USA  India

India