ACCT 360 Week 3 Accounting Assignment Help | Franklin University

- Franklin University / ACCT 360

- 24 Jan 2019

- Price: $10

- Other / Other

ACCT 360 Week 3 Accounting Assignment Help | Franklin University

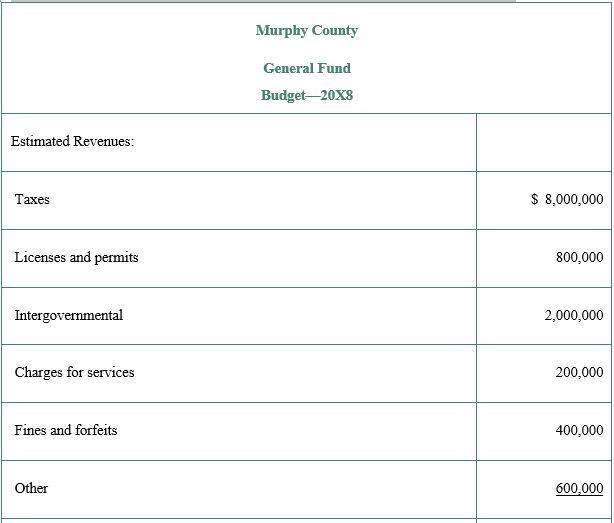

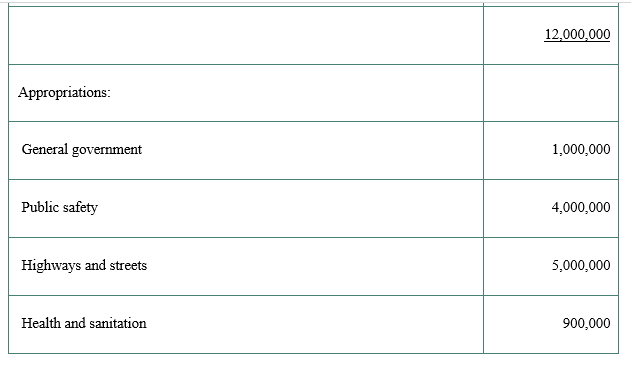

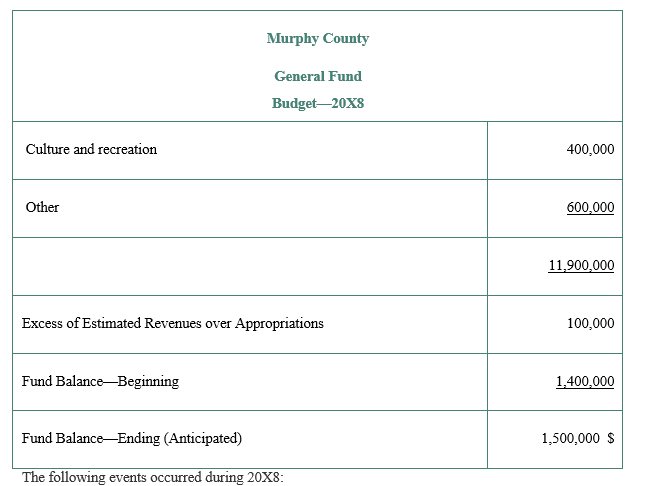

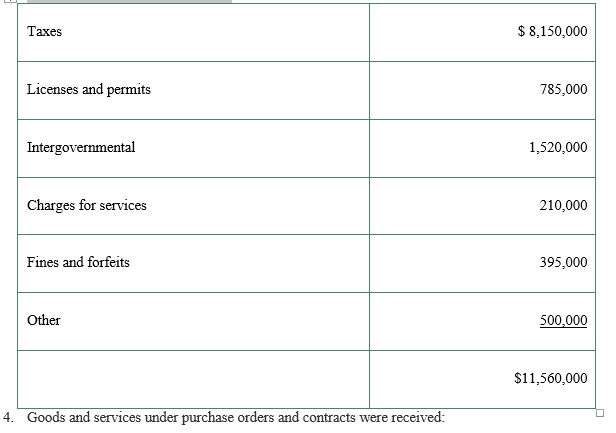

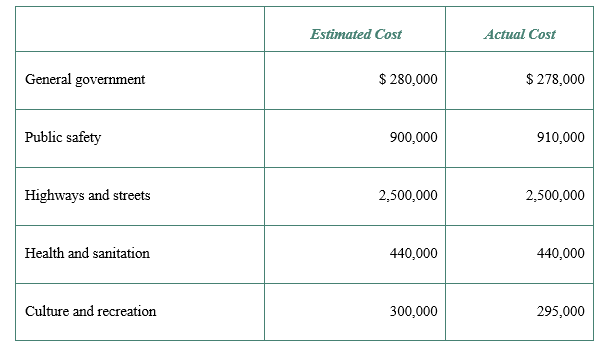

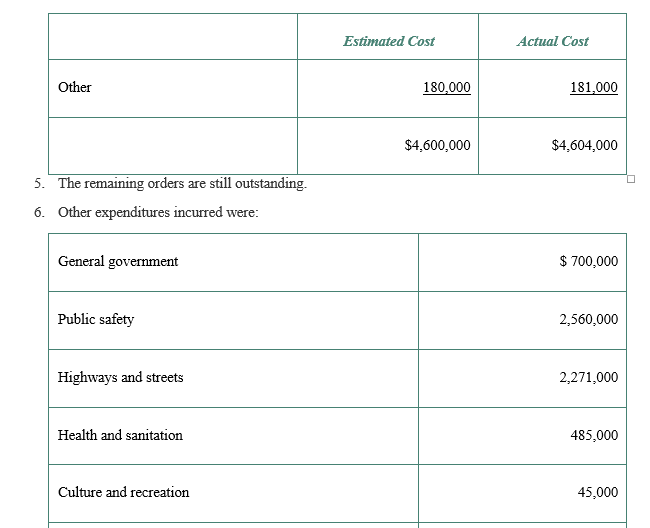

P3-2 (Budgetary and Other Entries—General and Subsidiary Ledgers) The Murphy County Commissioners adopted the following General Fund budget for the 20X8 fiscal year:

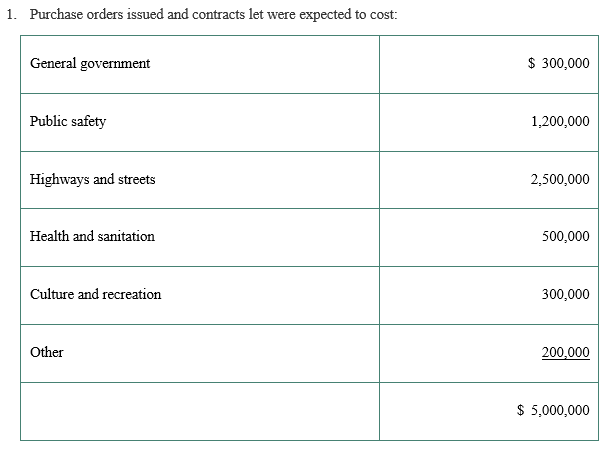

1.

The commissioners reviewed the budget during the year and (a) revised

the estimate of Intergovernmental Revenues to $1,500,000 and reduced the Public

safety and Highways and streets appropriations by $225,000 each to partially

compensate for the anticipated decline in intergovernmental revenues, and (b)

increased the Health and sanitation appropriation by $70,000 because of costs

incurred in connection with an unusual outbreak of Tasmanian flu.

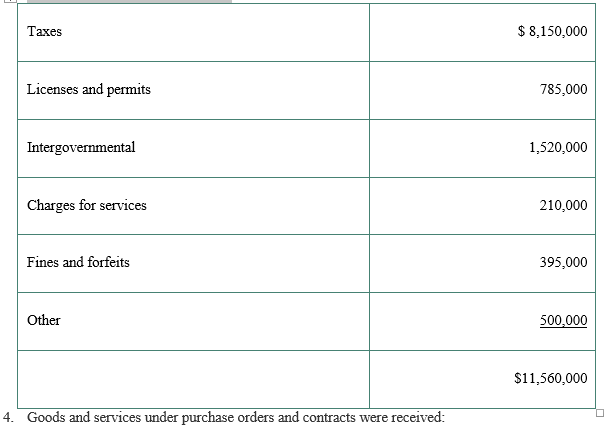

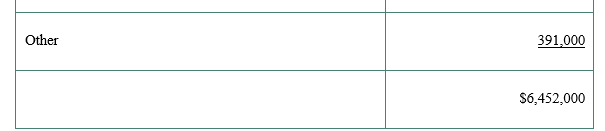

2. Revenues (actual) for 20X8 were:

Required

1. Set up general ledger T-accounts

like those in Illustration 3-1 and

also revenues and expenditures subsidiary ledgers like those in Illustrations 3-2and 3-3.

2. Record the Murphy County 20X8

General Fund budget in the general ledger and subsidiary ledger accounts,

keying these entries “B” (for budget). Then record the numbered transactions

and events, keying these entries by those numbers.

P4-6 (Debt-Related Transactions) Prepare the general journal

entries to record the following transactions of the Quinones County General

Fund:

1. Quinones County borrowed

$1,000,000 by issuing 6-month tax anticipation notes bearing interest at 6%.

The notes are to be repaid from property tax collections during the fiscal

year.

2. The county repaid the tax

anticipation notes, with $30,000 interest, at the due date.

3. The county purchased a new

patrol car 2 months before the end of the fiscal year. It cost $35,000. The

county paid $5,000 upon receipt and signed a 9% short-term note payable for the

balance.

4. The county services one of

its general obligation serial bond issues directly from the General Fund (a

Debt Service Fund is not used). The annual principal and interest payment,

which is due 2 months before year end, was paid. The principal payment was

$200,000 and the interest was $120,000. (Next year’s interest payment will be

$108,000.)

5. Record all appropriate

interest accruals.

USA

USA  India

India