ACCT 360 Week 1 Accounting Assignment Help | Franklin University

- Franklin University / ACCT 360

- 24 Jan 2019

- Price: $10

- Other / Other

ACCT 360 Week 1 Accounting Assignment Help | Franklin University

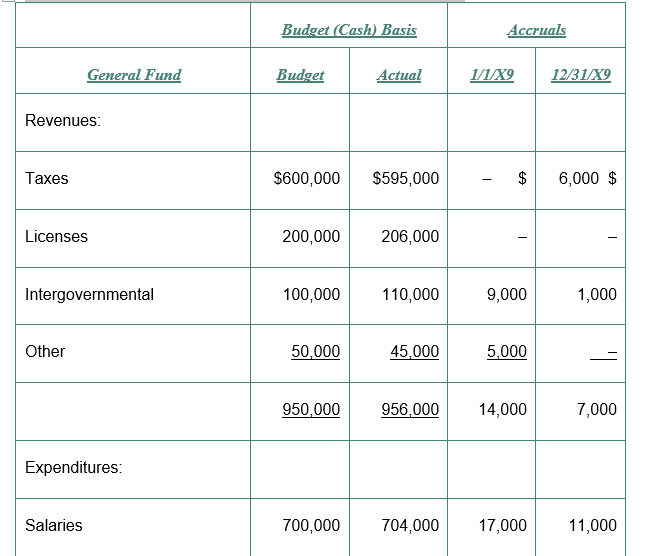

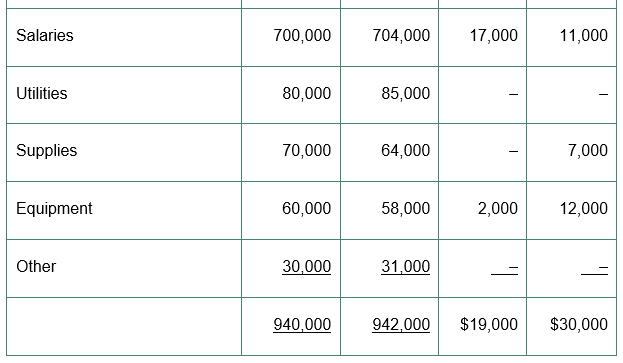

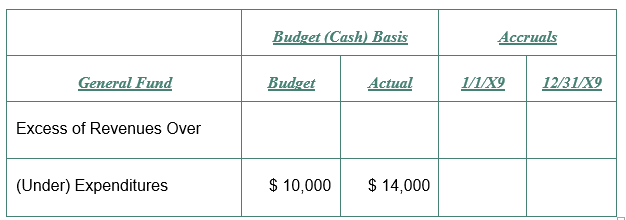

1. 1. P1-1 (Statement of Revenues and Expenditures—Worksheet) Hatcher Township prepares its annual General Fund budget on the cash basis and maintains its accounting records on the cash basis during the year. At the end of Hatcher Township’s 20X9 calendar year, you determine the following:

1.

Required

1.

Prepare a worksheet to derive a GAAP

basis (including accruals) statement of revenues and expenditures for the

Hatcher Township General Fund for the 20X9 fiscal year.

2.

Could the readers of the budgetary

basis and GAAP basis statements get different impressions of the 20X9 operating

results of the Hatcher Township General Fund? Explain.

2.

P1-2 (SLG GAAP Hierarchy) Mark

O. Sleuth, a recent accounting graduate, has been assigned to research several

local governmental accounting and financial reporting issues. For each issue,

rank the sources of guidance according to the governmental GAAP hierarchy.

1.

Issue 1: The AICPA state and local

government (SLG) Audit and Accounting Guide, a GASB Technical Bulletin, a

leading governmental accounting textbook, a GASB Interpretation, and a section

of the FASB Accounting Standards Codification

2.

Issue 2: A leading governmental

accounting textbook, a GASB Implementation Guide, an article in a leading

auditing journal, and a speech by a leading governmental accounting professor

3.

Issue 3: The AICPA SLG Audit and

Accounting Guide, a GASB Statement, a journal article that summarizes current

practice on the issue in the United States, notes from a telephone conversation

on the issue with the GASB director of research, and a FASB Accounting

Standards Update

4.

Issue 4: An AICPA Statement of

Position (cleared by the GASB), an article by the managing partner of an

international public accounting firm, a GASB Technical Bulletin, and the FASB

Accounting Standards Codification

5.

Issue 5: GASB Implementation Guide

2015-1, the AICPA SLG Audit and Accounting Guide, four articles from the Journal

of Accountancy, and a leading governmental accounting

textbook

6.

Issue 6: A predominant practice,

Statement of Governmental Accounting Concepts, an AICPA Statement of Position

not included in Level b

3.

P1-3 (Internet Research Problem)

Locate the homepages for the following organizations and prepare a brief

critique (one to three pages, perhaps with attachments) of the contents of each

site:

1.

Governmental Accounting Standards

Board

2.

Financial Accounting Standards Board

3.

American Institute of Certified

Public Accountants

4.

Government Finance Officers Association

5.

Association of Government Accountants

6.

National Association of State

Auditors, Comptrollers, and Treasurers

7.

National Association of College and

University Business Officers

8.

Association of School Business

Officials International

4.

P1-4 (Internet Research Problem)

Locate the GASB white paper, “Why Governmental Accounting and Financial

Reporting Is—And Should Be—Different,” on the Governmental Accounting Standards

Board website. Prepare a brief summary and critical analysis of the white

paper.

USA

USA  India

India

Question Attachments

0 attachments —