JWI 531 Week 6 Assignment Help | Strayer University

- strayer university / JWI 531

- 17 Sep 2018

- Price: $16

- Other / Other

JWI 531 Week 6 Assignment Help | Strayer University

Assignment 2

©2016 Strayer University. All Rights Reserved. This document contains Strayer University confidential and proprietary information

and may not be copied, further distributed, or otherwise disclosed, in whole or in part, without the expressed written permission of

Strayer University. This course guide is subject to change based on the needs of the class.

Page 1 of 4

Assignment 2: The Facebook Deal

Due Week 6, Day 7 (Weight: 16.5%)

The following are specific course learning outcomes associated with this assignment:

Evaluate the qualities of effective corporate governance.

Use technology and information resources to research issues in advanced financial management.

Write clearly and concisely about advanced financial management using proper writing

mechanics.

Introduction:

The past two modules have been a bit of a mash-up of different ideas and tools, which makes it

difficult to ask you to perform a neat, simple task that covers all the material that we covered.

Instead, we’re going to ask you to synthesize the bigger concepts from past lectures. We’re going

to do so using a company that most everyone is familiar with: Facebook.

Facebook, as everyone pretty much knows now, rocketed to popularity starting in 2005 and

hasn’t looked back since. As you might expect from a highly successful, capital-intensive, hightech

operation that’s growing at blazing speeds, the company has gone through several rounds of

financing to finance business growth. We’re going to ask you to look at that financing and explain

to us what happened.

Though a savvy researcher could find these transactions herself via Google if she truly wanted to,

we’ve gone ahead and pulled the big ones up for you in chronological order to save you some

time. We encourage you to investigate each of these further, however. There’s no shortage of

background on each of these. Here they are in nice news-bite capsules for digestion:

o The Facebook group announced that it has raised between $10 million to $12 million in

first-round financing led by Accel Partners on April 15, 2005. As a part of the transaction,

Jim Beyers, a Managing Partner at Accel Partners, joined the company's board. The

post-money valuation of the company was $100 million.

o Facebook, Inc. announced that it has raised $27.5 million in its third round of funding led

by new investor Greylock Partners on April 19, 2006. New investor MeriTech Capital

Partners and existing investor Accel Partners invested in the transaction. The postmoney

valuation of the company was $525 million.

o Facebook, Inc. announced that it will raise $240 million in an equity round of funding from

new investor Microsoft Corporation on October 24, 2007. As a result of the transaction,

Microsoft Corporation will now hold 1.60% stake in the company. The round was raised

at a post-money valuation of $15,000 million.

o Facebook, Inc. announced that it has raised $200 million in funding from Digital Sky

Technologies Limited on May 26, 2009. Digital Sky Technologies Limited invested in

preferred stock and acquired 1.96% stake, valuing the company at $10 billion.

So what really happened here? What were the major events surrounding and shaping these

investments? We want you to tell us the story of the business as it unfolded through these

massive transactions.

In order to successfully complete this assignment, you’ll have to rely on your powers to navigate

the world-wide web and your ability to work backwards a bit. The information is out there if you

know how to look. Remember that until recently, this was a private company, so we can’t easily

verify estimates on these financial numbers. So, be sure to justify your thinking with plenty of

evidence from similar businesses and events. Good luck!

Write a minimum 4 page paper in which you do the following:

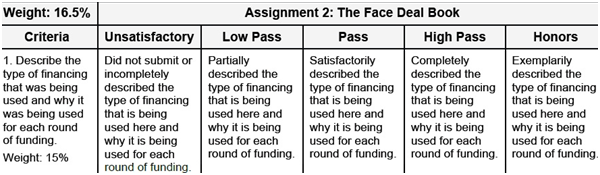

1. Briefly describe the type of financing that was being used here and why it was used for each

round of funding.

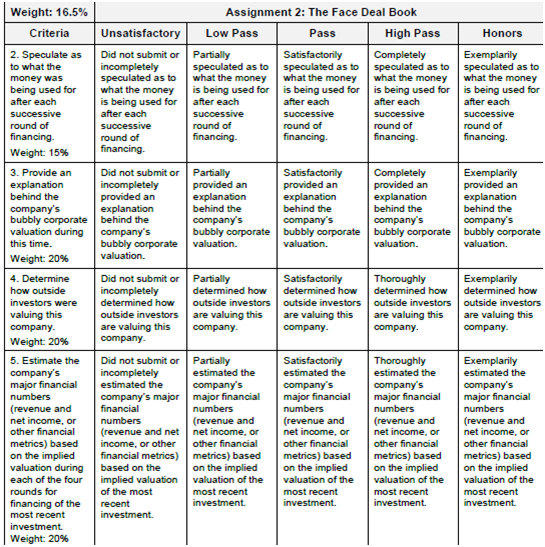

2. Speculate as to what the money was used for after each successive round of financing. (Don’t

forget, Facebook was raising money to finance certain projects.)

3. Provide an explanation behind the company’s bubbly corporate valuation during this time.

4. Determine how outside investors were valuing this company. (Hint: look at similar businesses.)

5. Estimate the company’s major financial numbers (revenue ,net income, or other financial metrics)

during each of the four rounds for financing.

Your assignment should adhere to these guidelines:

Write in a logical, well-organized conventional business style. Use Times New Roman font size

12 or similar, double-space, and leave ample white space per page.

All references must follow JWMI style guide, and works must be cited appropriately. Check with

your professor for any additional instructions on citations.

On the first page or in a header, include the title of the assignment, the student’s name, the

professor’s name, the course title, and the date. Title and reference pages are not included in the

assignment page length.

Faculty have discretion to penalize for assignments over or under the assignment guidelines.

Check with your individual professor if you feel the assignment requires a much longer or shorter

treatment than recommended.

Grading for this assignment will be based on answer quality, logic/organization of the paper, and

language and writing skills, using the following grading criteria.

USA

USA  India

India